Eitc 2025 Release Date. Book early to secure the cheapest. Get the latest irs guidelines for the 2025 eitc and child tax credit changes.

If you claimed the earned income tax credit (eitc) or the additional child tax credit (actc), you can expect to get your refund by february 27 if:

T150154 Extend ATRA Earned Tax Credit (EITC) Provisions, by, You have three years to file and claim a refund from the due date of your tax return. Get the latest irs guidelines for the 2025 eitc and child tax credit changes.

T160035 Senator Cruz's Tax Reform Plan with EITC Enhancement, by, You can claim a past eitc by either filing that year’s tax returns or, if you’ve already filed, amending your tax return for that year. Get the latest irs guidelines for the 2025 eitc and child tax credit changes.

T160035 Senator Cruz's Tax Reform Plan with EITC Enhancement, by, You can claim the eitc until the following dates:. Applicants will be able to fill the registration form through online mode.

EITC Biggest Factor Boosting Single Mothers' Employment, Research Finds, 2025 is already approaching with its own lineup of new air jordans we can look forward to. 29, 2025, as the official start date of the nation's 2025 tax season when the agency.

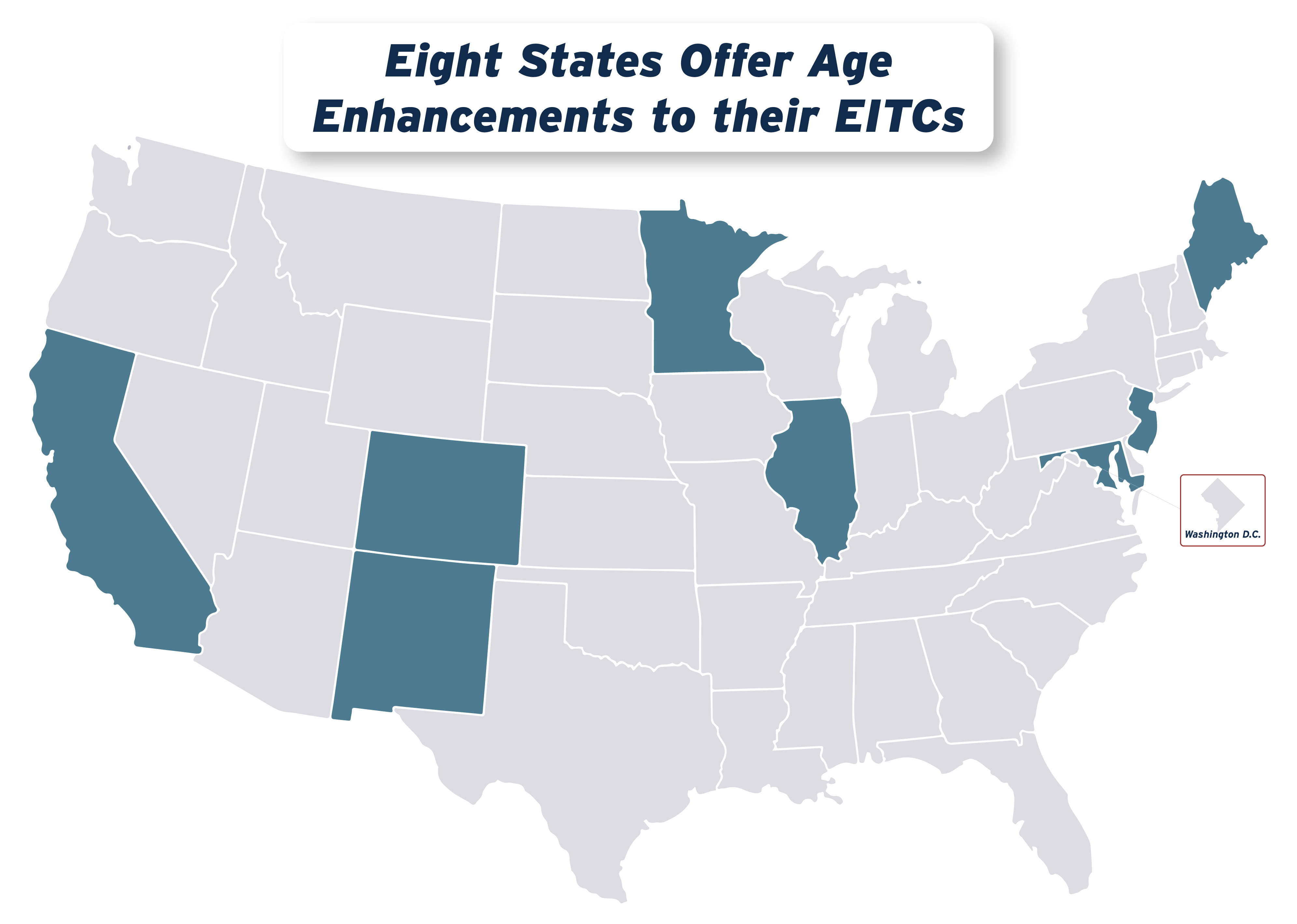

Boosting and Improving Tax Equity with State Earned Tax, The dates for the same. This chart lists all upcoming movies that will have a wide release in theaters in the united states and/or canada in 2025.

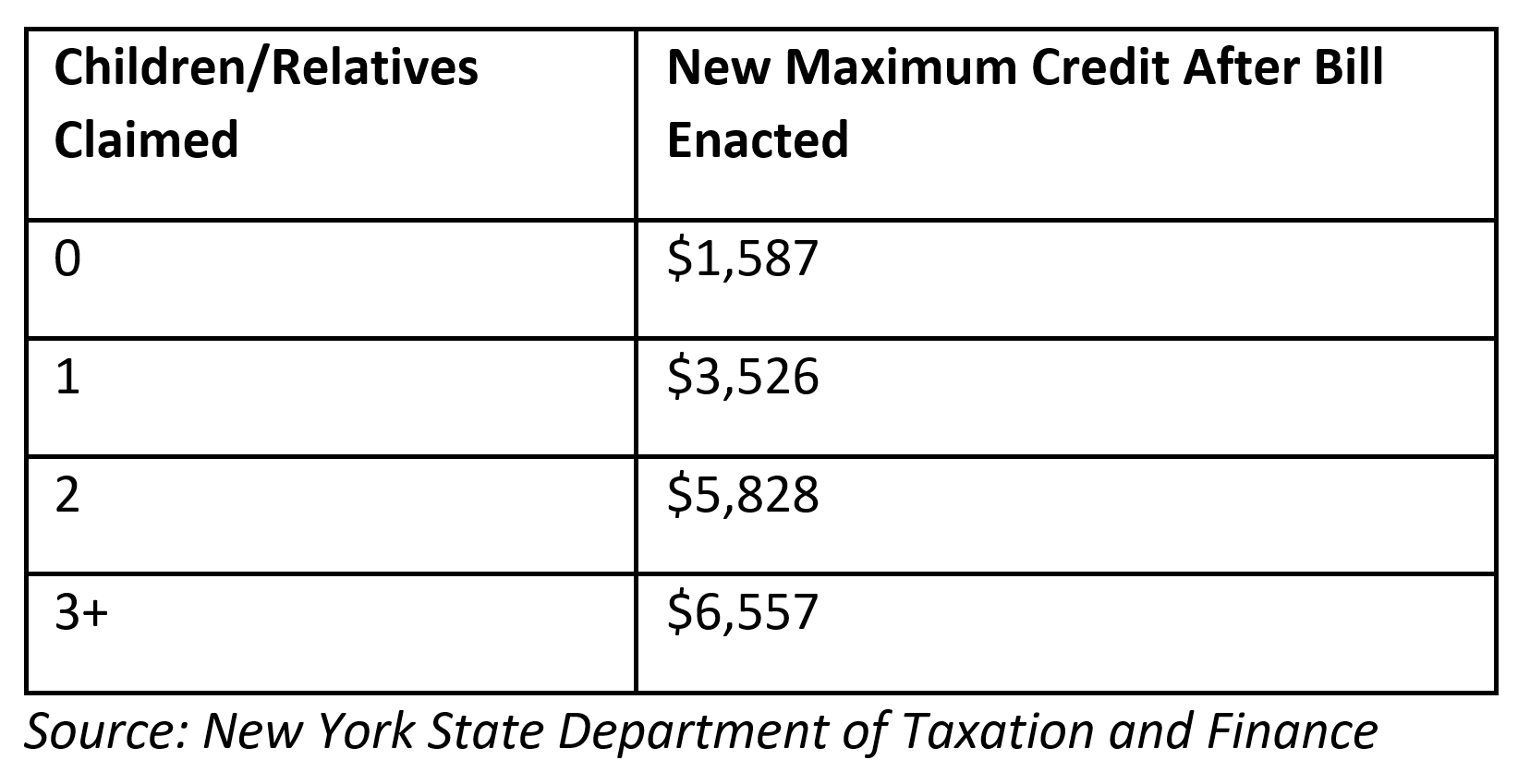

NY Lawmakers Urge Inclusion of Expanded Earned Tax Credit in, The average amount of eitc received. The irs website and app will be updated for most filers by february 17 — including expected refund dates for most early filers with the earned income tax credit.

Earned Tax Credit (EITC) A Primer Tax Foundation, Key highlights of the release date for. Release of final answer key:

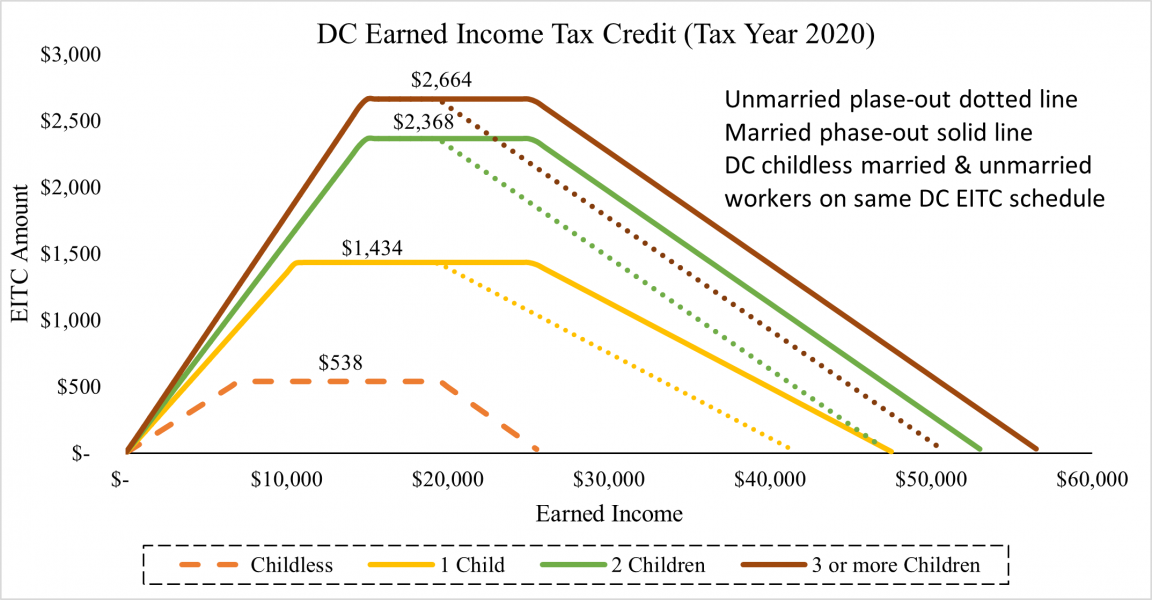

Brief Overview of DC EITC oracfo, To help you stay organized,. Learn how to qualify and maximize your refund when you file taxes for the.

IMPACT OF MINIMUM WAGE AND EITC INCREASES ON Download Table, Washington — the internal revenue service today announced monday, jan. To have your film listed, please.

Fewer Americans will qualify for this overlooked, but valuable tax credit, Release of final answer key: To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit.